Affiliated Advisors provides retirement planning services for companies and individuals in Denton County, the Dallas–Fort Worth area, and across Texas, helping clients balance tax efficiency, performance, and long-term financial security.

Two basic types of plans are available: the Qualified type of Plan with its benefits and the Non-Qualified plan with its benefits.

Which is best lies in the eyes of the beholder and their understanding of the impact of taxes and their expectations of what their money should do for them.

So here is what this website will cover in some detail:

The basic differences between the two categories will be discussed as we outline the variables of both.

- The first variable is the tax considerations under each.

- The next variable is understanding the costs of both.

- The third is the performance of both.

- The fourth is the simplicity or lack thereof for both.

- Who do you trust with your money?

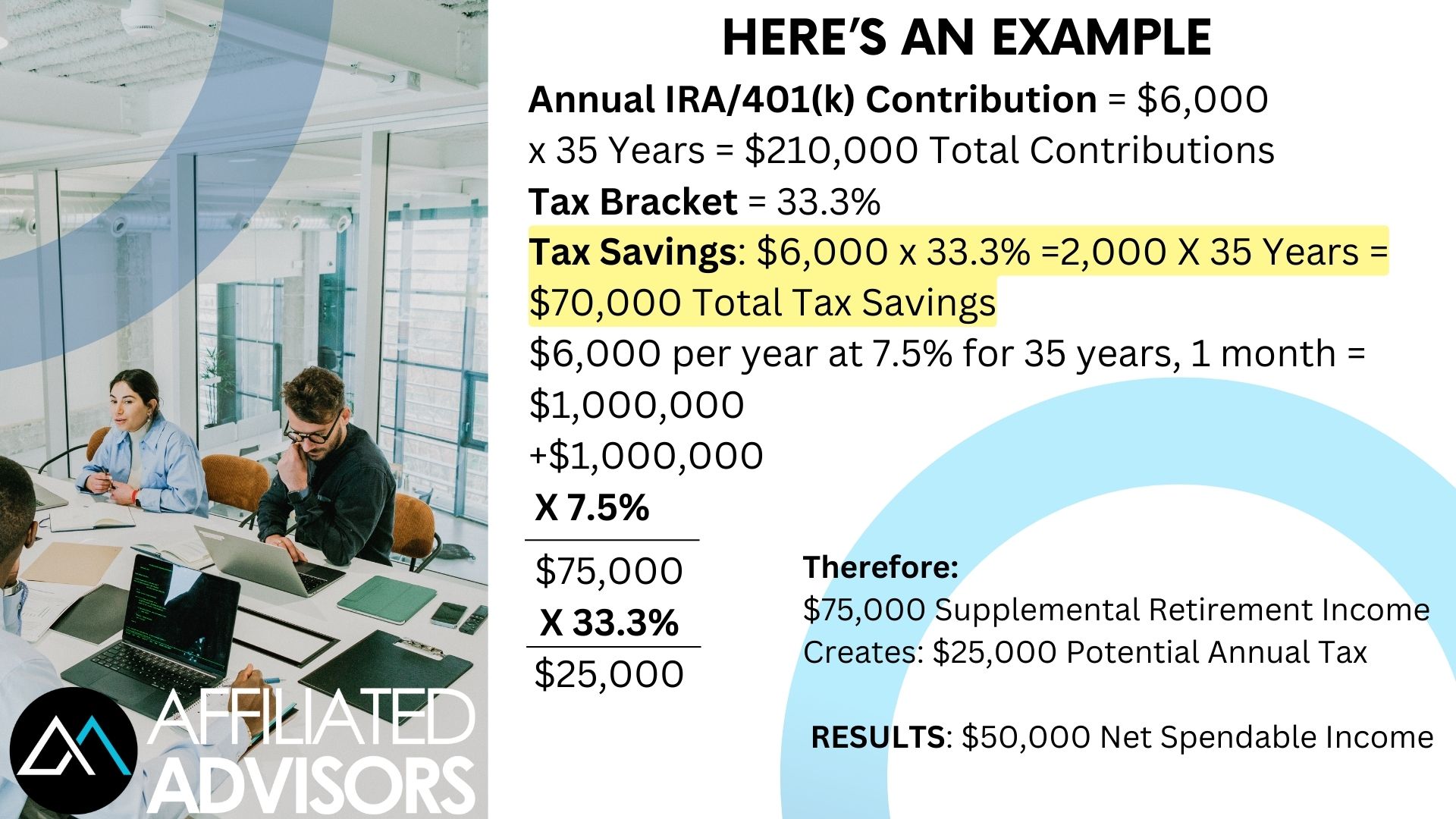

Below is an example of a retirement plan for an individual that will demonstrate the tax implications of the standard plan with some questions for you to answer to help you increase your understanding.

Here are a few questions you can ask yourself:

- How much in tax savings was realized from over the 35 years you were putting money into the plan?

- How many years after retirement does it take to pay enough tax to negate the savings, experienced from using a qualified retirement plan?

- How much in total tax will be paid over the next 25 years with the present Qualified plan?

- Assuming that a non-qualified plan was used that did not tax retirement income, how much more money would be realized in the 20 years after retirement?